The Facts About Feie Calculator Uncovered

Table of ContentsFeie Calculator Things To Know Before You BuyGet This Report about Feie CalculatorGetting The Feie Calculator To WorkGetting The Feie Calculator To WorkExcitement About Feie Calculator

He sold his United state home to establish his intent to live abroad permanently and used for a Mexican residency visa with his wife to aid satisfy the Bona Fide Residency Test. Additionally, Neil secured a lasting home lease in Mexico, with plans to eventually purchase a home. "I currently have a six-month lease on a house in Mexico that I can extend another 6 months, with the objective to purchase a home down there." Neil directs out that buying residential or commercial property abroad can be challenging without very first experiencing the location."We'll certainly be beyond that. Even if we come back to the US for physician's visits or organization calls, I doubt we'll invest even more than one month in the US in any kind of given 12-month period." Neil emphasizes the importance of rigorous monitoring of U.S. gos to (Physical Presence Test for FEIE). "It's something that people require to be actually diligent regarding," he states, and recommends expats to be careful of usual errors, such as overstaying in the united state

Top Guidelines Of Feie Calculator

tax responsibilities. "The reason that U.S. tax on around the world revenue is such a big deal is since lots of people neglect they're still subject to U.S. tax obligation even after relocating." The U.S. is just one of minority nations that taxes its residents despite where they live, implying that even if a deportee has no income from united state

income tax return. "The Foreign Tax Credit report allows individuals functioning in high-tax nations like the UK to offset their united state tax obligation by the amount they have actually currently paid in taxes abroad," states Lewis. This makes sure that deportees are not tired twice on the same revenue. However, those in low- or no-tax countries, such as the UAE or Singapore, face added hurdles.

Not known Factual Statements About Feie Calculator

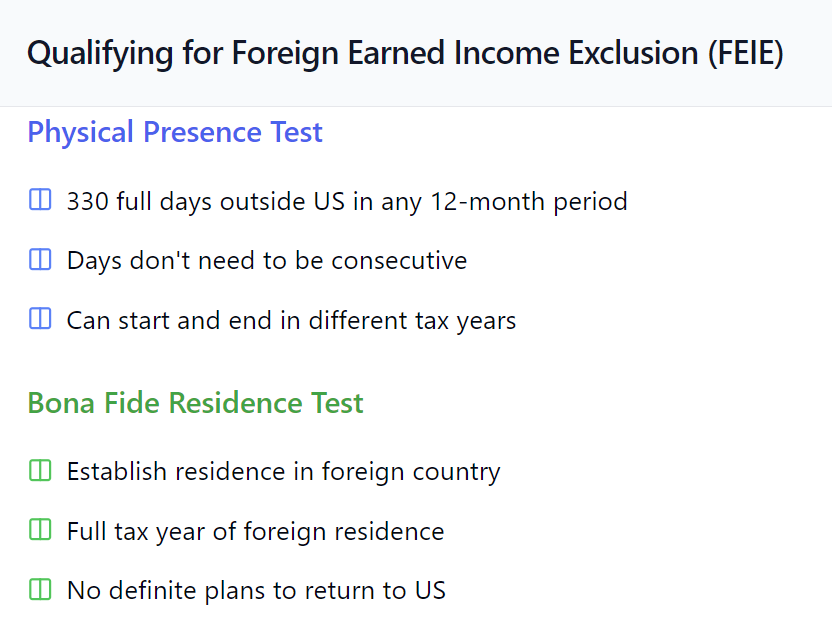

Below are several of one of the most regularly asked questions about the FEIE and other exclusions The Foreign Earned Earnings Exemption (FEIE) permits united state taxpayers to leave out up to $130,000 of foreign-earned revenue from government income tax, minimizing their united state tax obligation liability. To qualify for FEIE, you need to fulfill either the Physical Visibility Test (330 days abroad) or the Bona Fide Home Test (verify your main house in a foreign nation for a whole tax obligation year).

The Physical Visibility Examination requires you to be outside the U.S. for 330 days within a 12-month duration. The Physical Visibility Examination likewise calls for united state taxpayers to have both an international earnings and a foreign tax home. A tax home is specified as your prime place for service or employment, no matter of your family members's home.

How Feie Calculator can Save You Time, Stress, and Money.

An income tax treaty in between the U.S. and an additional country can aid stop dual tax. While the Foreign Earned Income Exclusion lowers gross income, a treaty may supply added benefits for eligible taxpayers abroad. FBAR (Foreign Savings Account Report) is a required declaring for united state citizens with over $10,000 in foreign economic accounts.

Eligibility for FEIE relies on conference particular residency or physical existence tests. is a tax obligation advisor on the Harness platform and the creator of Chessis Tax. you can try here He belongs to the National Organization of Enrolled Representatives, the Texas Culture of Enrolled Brokers, and the Texas Society of CPAs. He brings over a years of experience functioning for Large 4 firms, encouraging expatriates and high-net-worth people.

Neil Johnson, CERTIFIED PUBLIC ACCOUNTANT, is a tax consultant on the Harness system and the owner of The Tax Dude. He has over thirty years of experience and now specializes in CFO solutions, equity payment, copyright taxation, marijuana taxes and divorce associated tax/financial planning issues. He is an expat based in Mexico - https://hearthis.at/feiecalcu/set/feie-calculator/.

The international made revenue exclusions, sometimes referred to as the Sec. 911 exemptions, exclude tax on earnings earned from functioning abroad.

Some Known Details About Feie Calculator

The tax benefit omits the income from tax at bottom tax obligation rates. Formerly, the exemptions "came off the top" decreasing income subject to tax obligation at the leading tax rates.

These exclusions do not spare the incomes from United States tax however just offer a tax reduction. Note that a bachelor functioning abroad for every one of 2025 who earned about $145,000 without other income will certainly have taxed earnings decreased to zero - effectively the very same solution as being "tax totally free." The exemptions are calculated every day.